Guide on How to Update GST Rates in TallyPrime

Follow the steps explained below to Update GST Rates in TallyPrime

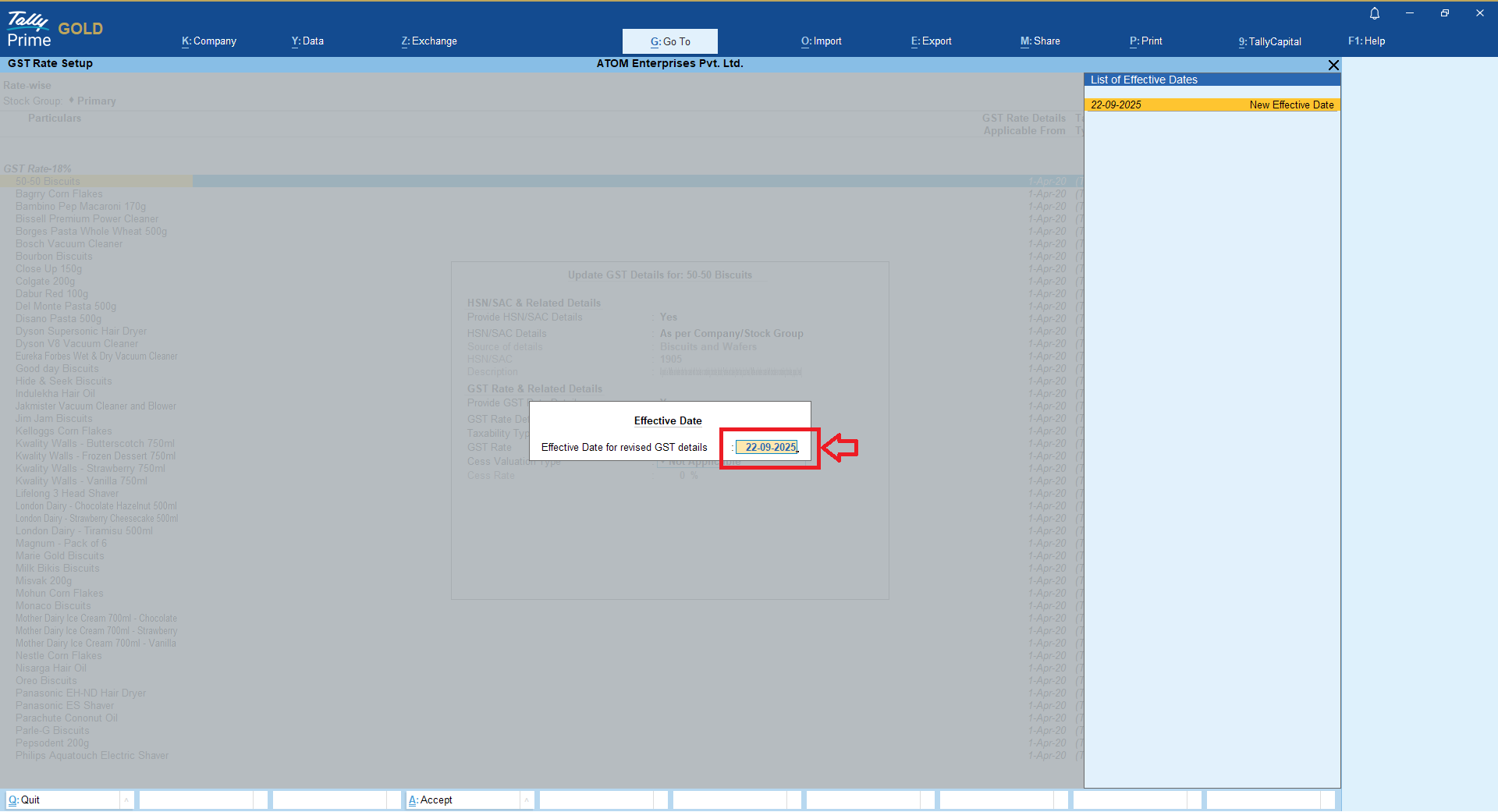

As you aware about the recent GST 2.0 reforms, which came into effect from 22nd September 2025, as announced in the 56th GST Council Meeting. The new structure simplifies tax rates and makes essential goods more affordable then earlier.

Here is the quick guide on how you can update newly rolled-out GST rates in your TallyPrime keeping old GST rate intact for your past transactions.

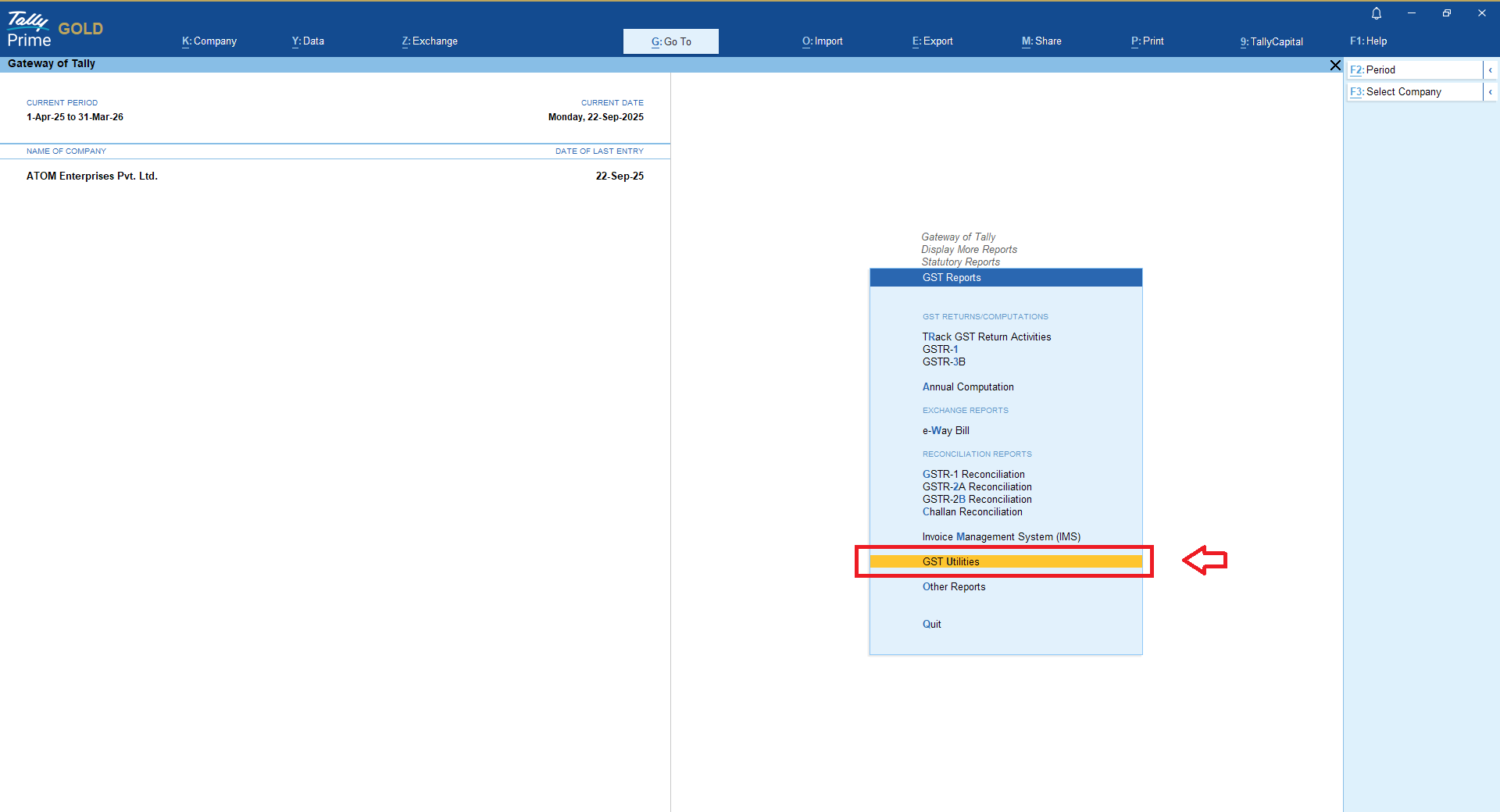

From Gateway of TallyPrime navigate to Display More Reports > Statutory Reports > GST Reports > GST Utilities as shown in below snapshot;

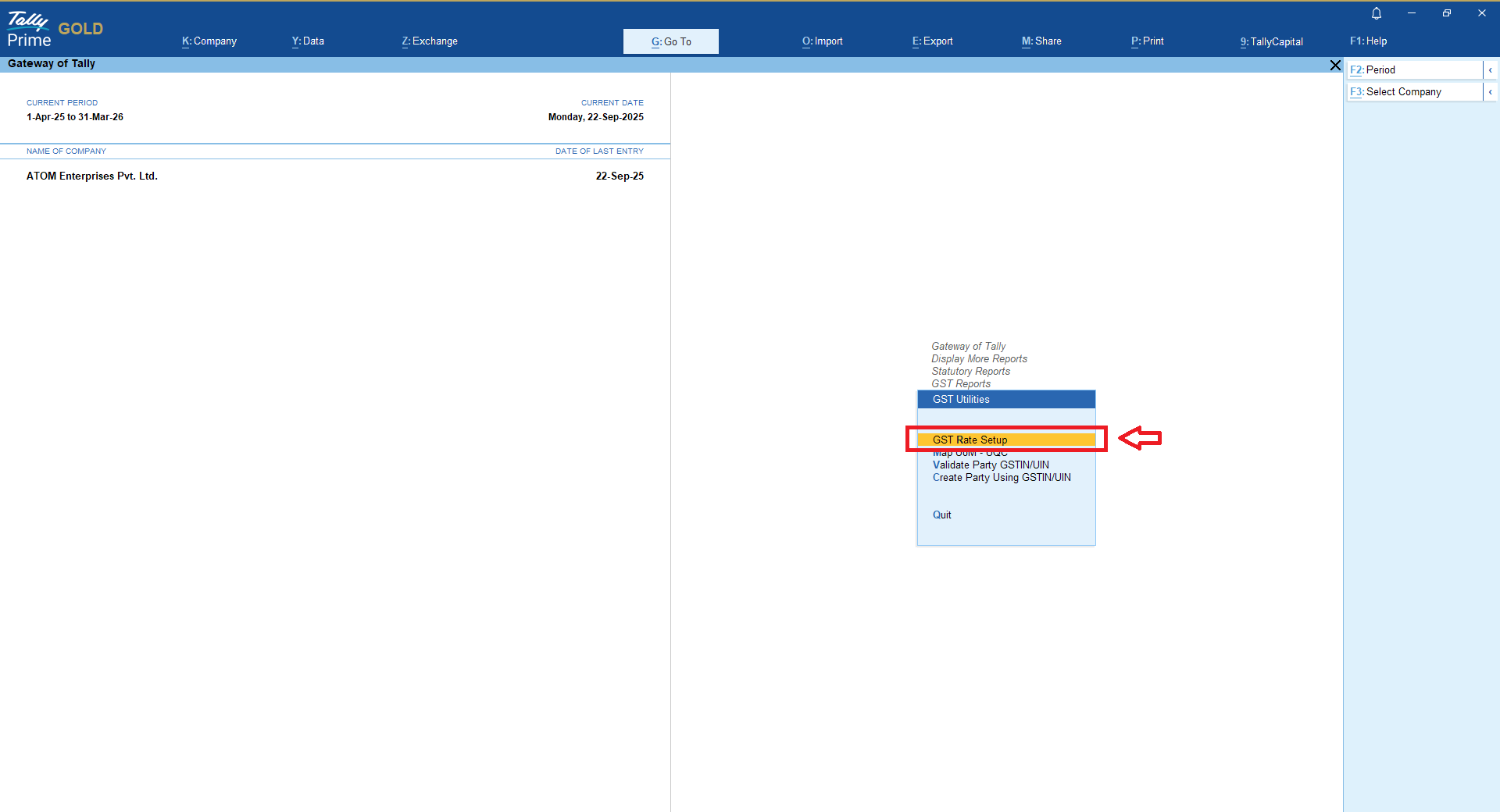

Then navigate to “GST Rate Setup”

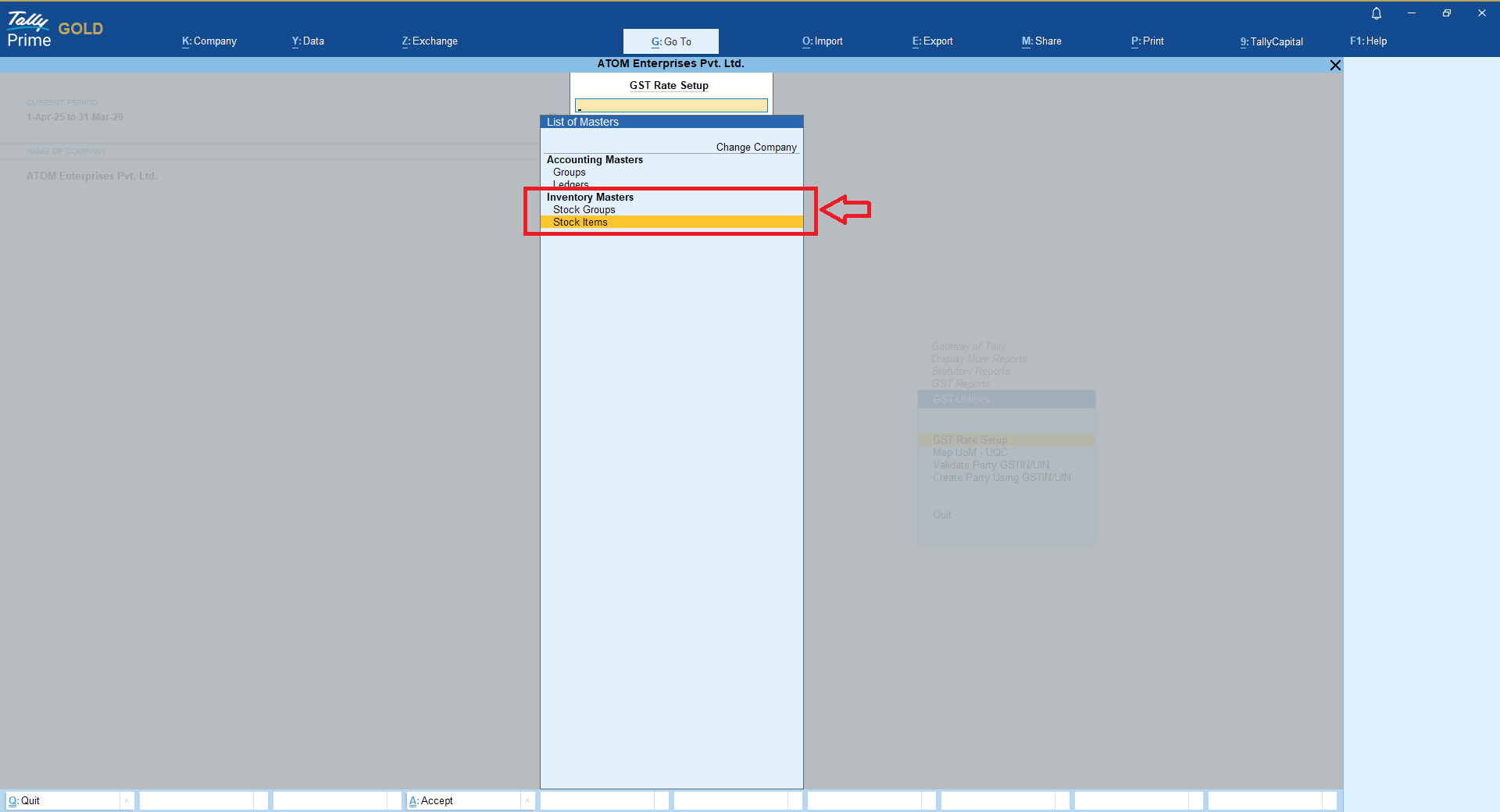

Then either choose “Stock Group”, if you want to update GST Rate for all the stock items belongs to a particular stock group

OR

Choose “Stock Items“, if you want to update GST Rate for Single or Multiple selected stock items

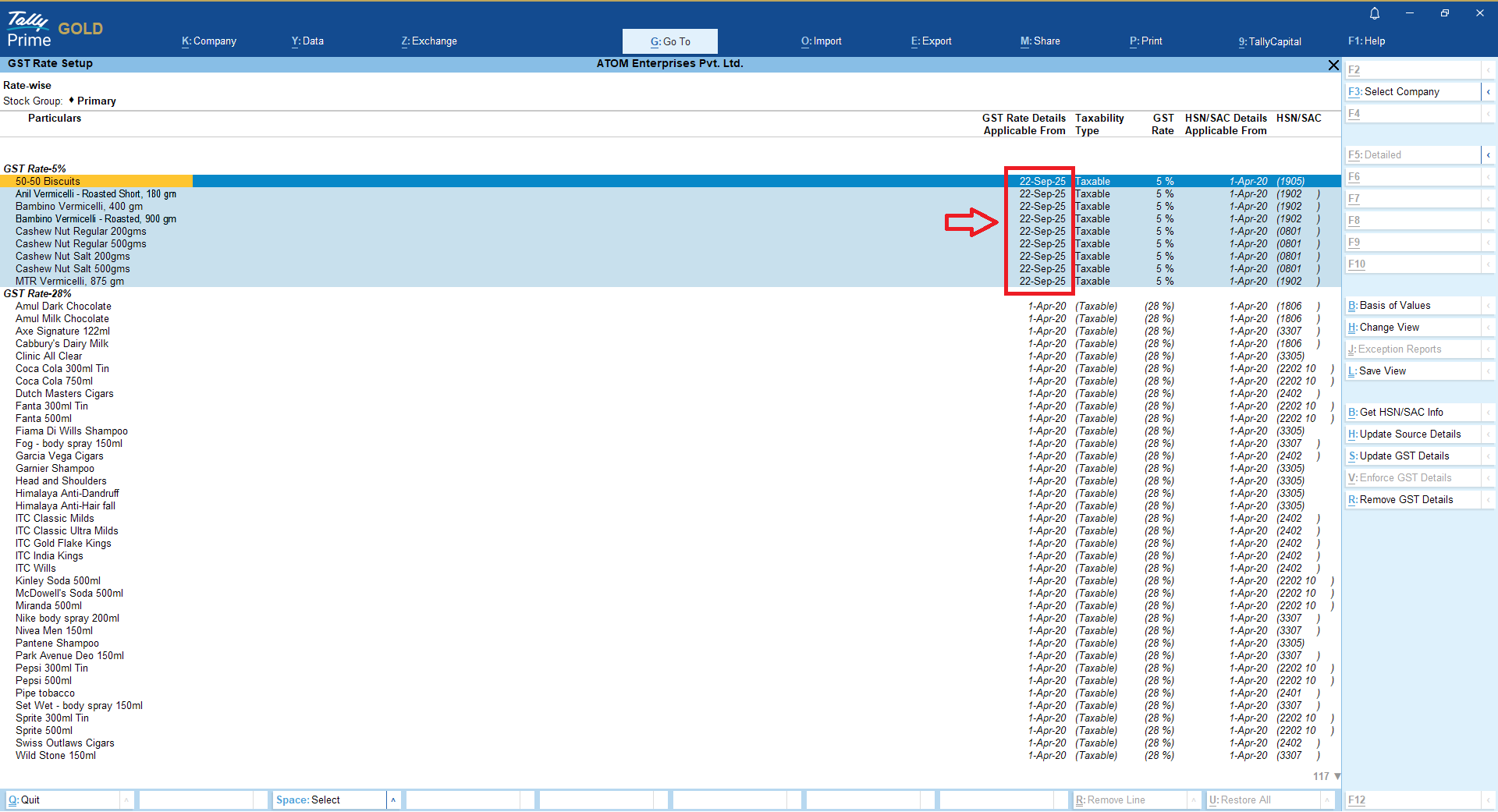

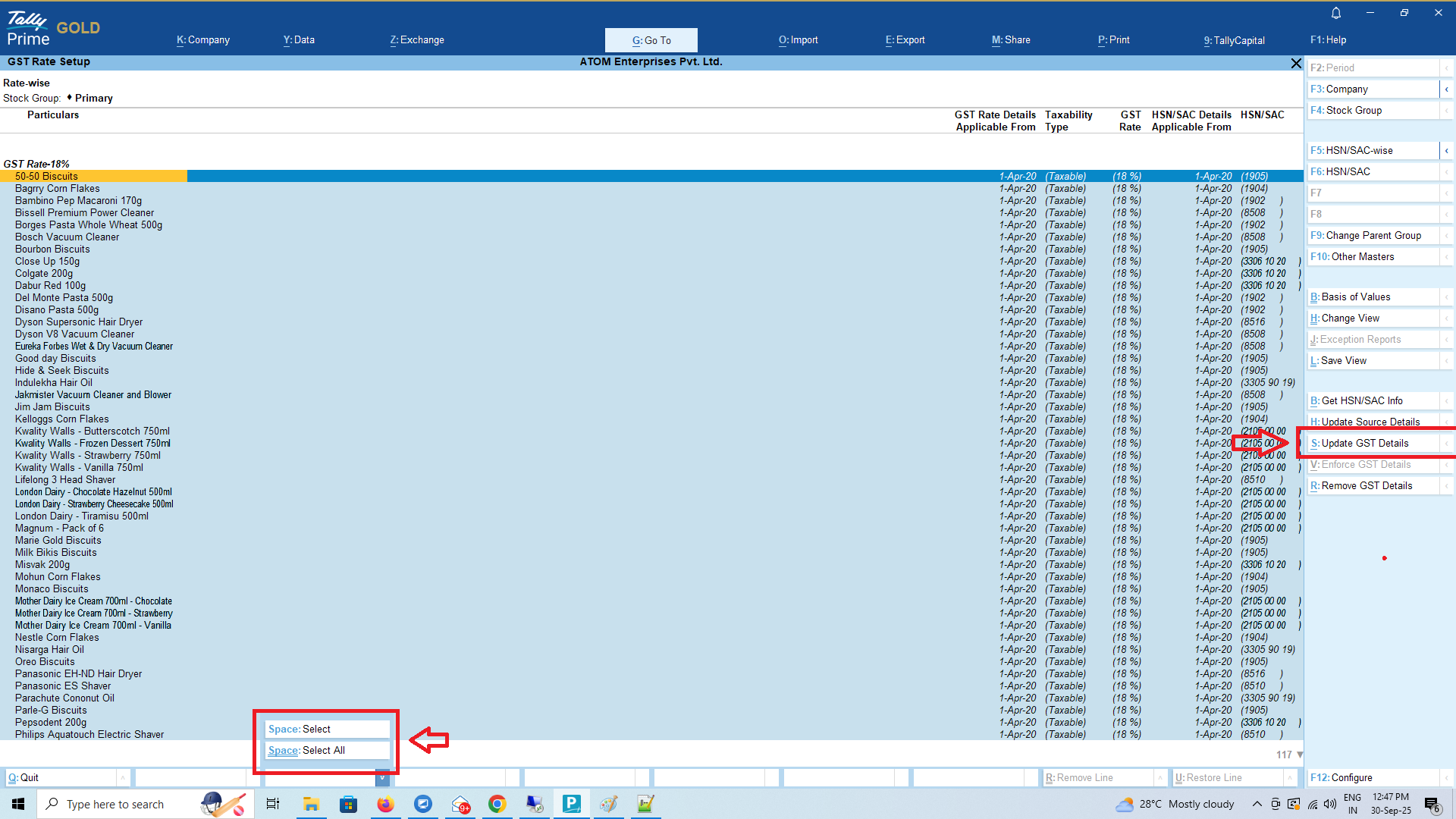

Then click on “Select” or “Select All” option for which GST rate to be updated

Then click on button “Update GST Details”

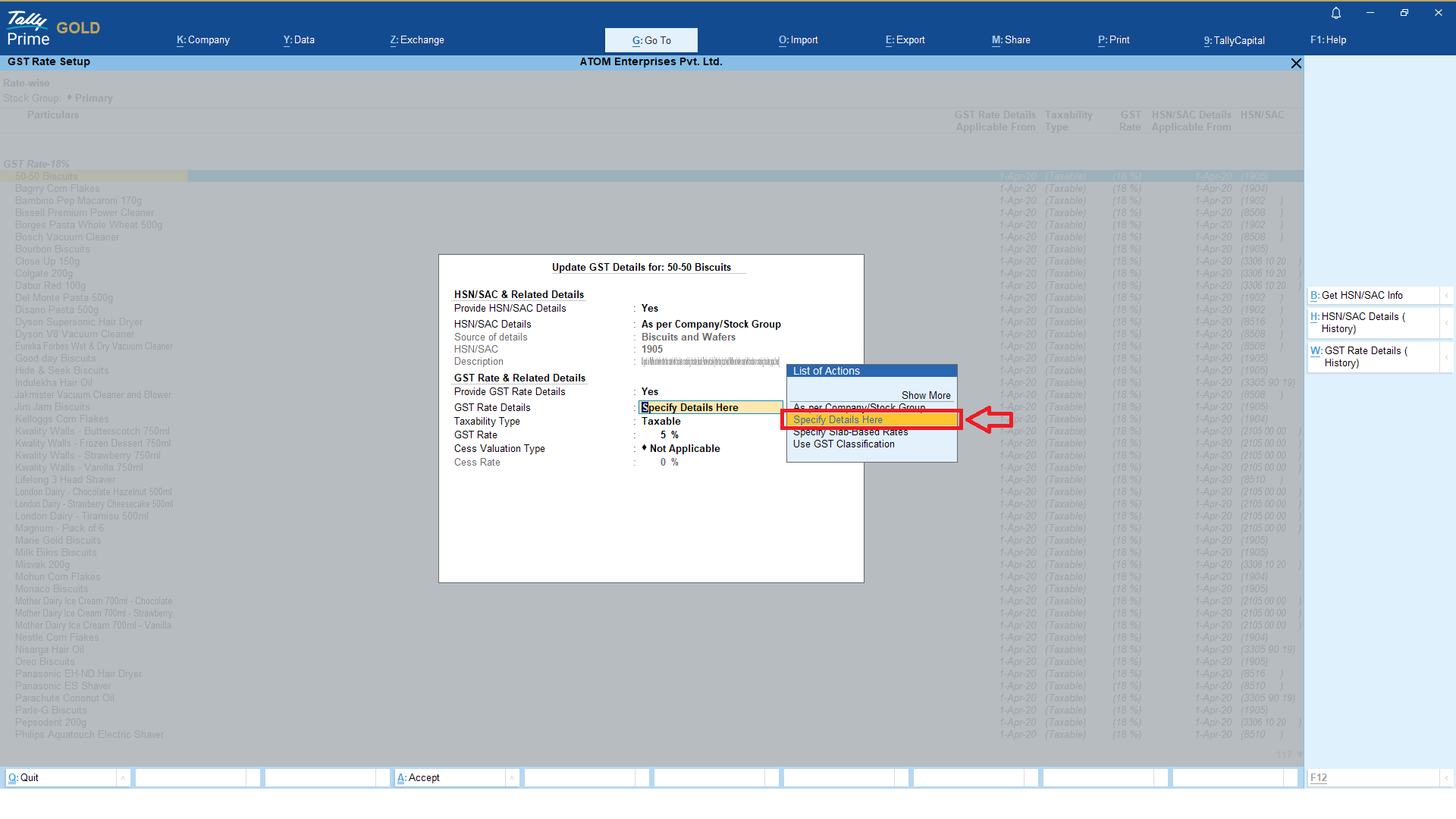

A new window will be prompted to update GST Rate for selected stock items

Here you may choose the option “Specify Details Here” and enter revised GST Rate

Then you will be prompted to enter Effective Date for the revised GST Rate

It’s Done