In the Finance Act 2020, the Government has introduced new rules in Section 194-O which provides a withholding of TDS by e-commerce companies for facilitating sale of goods and services of e-commerce participants through its marketplace. These rules are effective October 1, 2020.

Many sellers like you have came across the query of how to account the same in Tally? Please refer the steps below to learn how to record TDS deducted by Amazon in Tally.

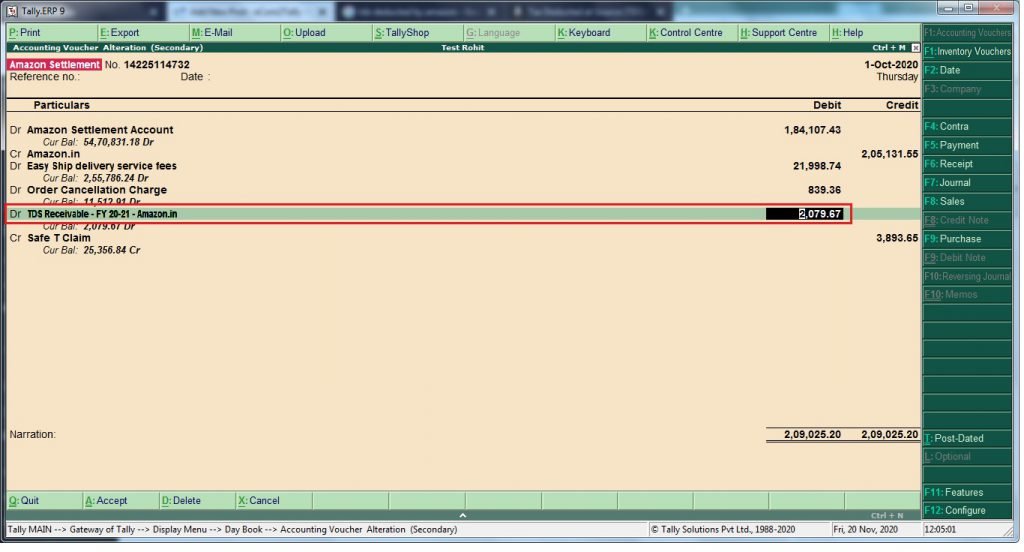

Recording TDS Receivable Entry

Check for the TDS values in the settlement you received as shown in below snapshot; apply filter on column “type” and check for the type ” Tax Withheld ”

We recommend you to record the TDS receivable entries settlement ID wise for better tracking and reconciliation.

Debit TDS Receivable Ledger (Create under Current Assets or Duties & Taxes)

Recording TDS Refund Received Entry

When you receive refund from the department, record following entry;

Recording TDS Receivable to be claimed as GST credit

Go to journal voucher and press ALT+J: Stat Adjustment button, debit GST ledger and credit TDS Receivable ledger as shown in below sample entry;

In this way you can record TDS receivable entry and adjust the same either via receipt or journal adjustment

Frequently Asked Questions (FAQ) on Tax Deducted at Source (TDS) under proposed section 194-O of the Income Tax Act, 1961

1. What does TDS on e-commerce transactions mean?

An e-commerce operator will be required to withhold and deposit to the Government a % of the gross sales of products/ services by sellers on the marketplace. This withholding is not applicable for offline sales by sellers.

2. What is the TDS %?

The TDS % on the gross sales of products/ services is 1% (0.75% for FY 2020-21 applicable till March 31, 2021). In case no Permanent Account Number (‘PAN’) or Aadhaar is provided by the seller or where the PAN is inoperative, the rate increases to 5%.

3. Are any online sellers excluded from the TDS?

There is an exclusion for Individuals and Hindu Undivided Sellers (HUFs) where the gross sales of the product or service during the financial year is less than INR 500,000 and PAN or Aadhaar is provided. Further, only Indian resident sellers are covered in the TDS rules.

4. What is the effective date of the TDS provisions?

The rules apply from October 1, 2020.

5. Whether the TDS will apply on a net sales i.e. after considering sales returns?

As per the Tax rules, TDS will be applied on the gross amount of sales from goods or services without considering sales returns.

6. Whether TDS will be applied on GST component also?

No, TDS will not be applied on GST component.

7. What proof of TDS deduction will be provided to the seller?

We understand that the provisions will be enabled for the e-commerce operator to issue a TDS certificate to the seller on a quarterly basis. Similar to existing TDS provisions, we understand that Sellers will be able to check the TDS in their Form 26AS at https://incometaxindiaefiling.gov.in. and also use the “View Your Tax Credit” facility available at www.incometaxindia.gov.in. If we receive clarification on this point, we will update this response.

8. How can the seller claim credit or refund for the TDS deducted?

The seller can claim credit or refund for the TDS deducted by filing an income tax return for that financial year, as per their applicable due dates. Sellers may consult their respective tax advisors for the same.

9. What is the TAN number of Amazon Seller Service Private Limited if seller wish to apply for a Lower TDS exemption certificate?

TAN number of Amazon Seller Service Private Limited is “BLRA14702C”.

10. How can we share lower TDS exemption certificate?

To share the lower TDS exemption certificate (LDC), please Contact Seller Support and create a case with the subject line: TDS LDC. Attach a PDF copy of Lower TDS exemption Certificate (LDC).

Please check and ensure that certificate is eligible and contains Amazon name and Amazon PAN.