How to Record TCS deducted by the Flipkart in Tally?

Tax Collected at Source (TCS) under GST means the tax collected by an e-commerce operator from the consideration received by it on behalf of the supplier of goods, or services who makes supplies through operator’s online platform. TCS will be charged as a percentage on the net taxable supplies.

Flipkart Tax Report contains the Invoice wise breakup of TCS deducted on each orders. In order to account the same in Tally, you will have to Debit the TCS Ledger and Credit the Flipkart Ledger.

To account TCS entries in bulk on all the orders in a particular month, you can use our Journal Template to simplify this task.

Follow the steps below to import Flipkart deducted TCS to Tally;

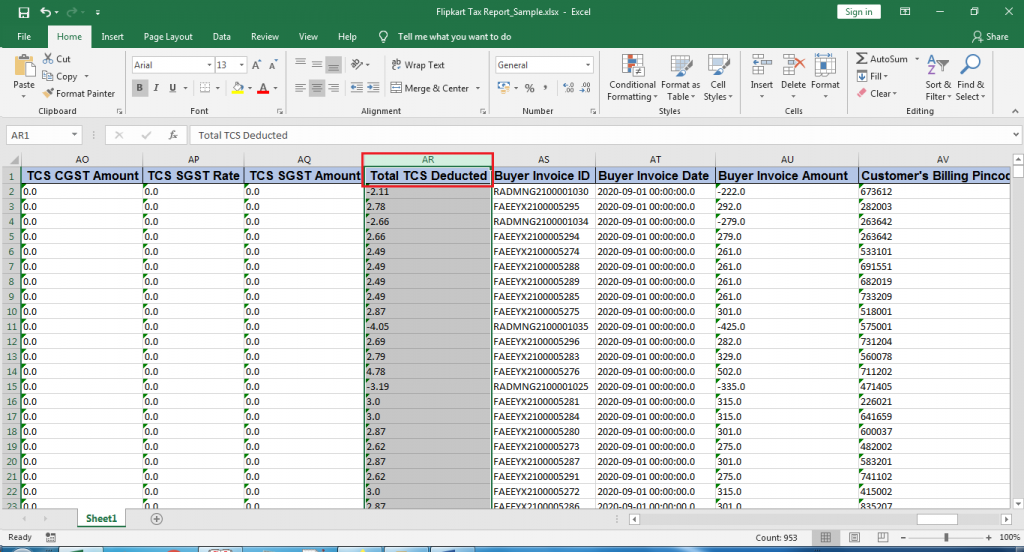

- Open your Flipkart Tax file, you will find a column ” Total TCS Deducted “, this column is a sum of TCS deducted on CGST + SGST & IGST.

- You will have to copy this data to our Journal Template as explained below;

- Date: This will be the last date of the particular month

- Voucher Number: This will be the next voucher number as per your Tally

- Voucher Type: We recommend to create a new Voucher type as Flipkart TCS under Journal

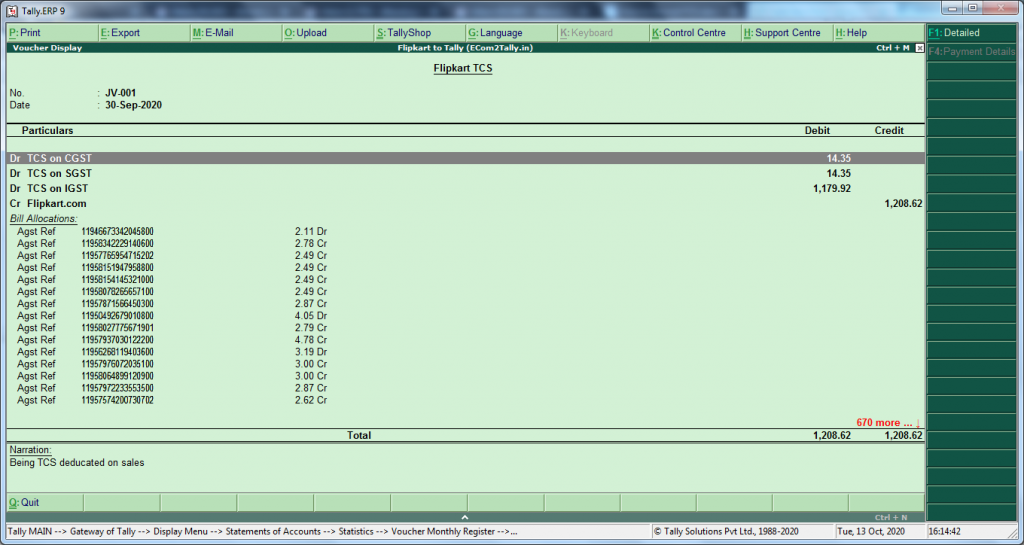

- Ledger Name: Set TCS on CGST, TCS on SGST and TCS on IGST ledger as Debit and Flipkart.com as a Credit

- Debit / Credit: Set “Dr” for debiting the TCS ledger and “Cr” for crediting the Amazon.in ledger

- Reference No: Copy Flipakrt Order Numbers in this column to knock off TCS against Invoice

- Amount: This will be the sum amount of ledger TCS on CGST, TCS on SGST and TCS on IGST respectively

- Once your data is ready, convert it to the XML file using eCom2Tally data convertor application and import the XML file to Tally. This will import order wise TCS deducted data for the month as shown in below sample voucher

- This will knock-off the TCS deducted value against each order and help you to account TCS credit accurately

Flipkart TCS to Tally Sample

Send Manual to my Email ID